09 November 2022

Over a third of newly launched medicines fail to meet launch expectations despite the rising cost of bringing an asset to market. Successful access to newly launched medicines is critical in driving a reliable ecosystem of funding for biopharma R&D, promoting innovation and ensuring sustainability within the healthcare system for patients.

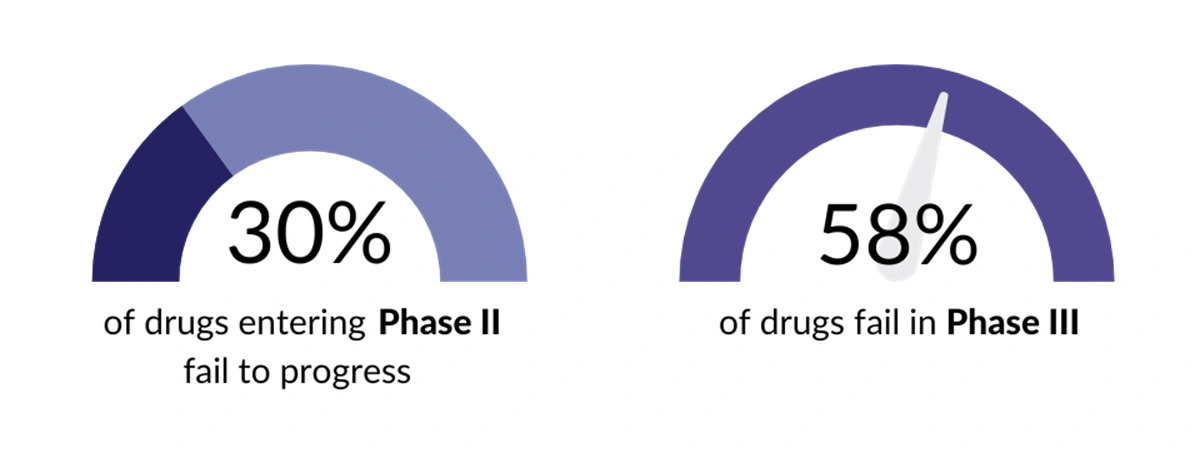

Failed medicine launches reduce the return on investment for biopharma and have a detrimental impact on future financing and R&D. Research shows that Phase II clinical studies represent a critical point in determining drug costs but is a poor predictor of drug success with more than 30% of drugs entering Phase II studies failing to progress. Around 58% of drugs go on to fail in Phase III with the main reasons being a lack of supporting data around efficacy, safety, and commercial viability.

As drug pipelines shift from treating broad patient populations to targeted and personalised therapies, faster routes to market, such as adaptive trial designs and launches across multiple indications through basket trials, fuel greater competitor intensity. This, in combination with the ever-increasing cost of drug development, payer policy reforms and budgetary pressures, can be a challenge for launch success. A key determinant of success or failure is dependent on market access strategy and effective execution.

Starting with the end in mind

Starting with the end in mind concept, a successful launch outcome is defined as full patient access to the medicine in a timely manner, at a price that fits payer budgets and secures commercial viability for biopharma. The journey to successful market access typically starts with sound asset and indication selection. Subsequent value demonstration based on clinical and economic evidence and product differentiation within an unmet need, support the effective communication and alignment with payers for successful asset launch.

GPI’s R&D efforts are focused on understanding criteria for successful asset selection, market access prediction and methods for operationalising market access strategy.

- Asset and indication selection/prioritisation: Manufacturers should consider factors that determine successful asset and indication selection such as the treatment paradigm, indication sequence, unmet need, degree of innovation, commercial viability, price and access options and trade-offs

- Agility: Applying agile strategy and operations across the portfolio, such as advanced analytics, predictive modelling and artificial intelligence, optimises the quality and speed of decision-making

- Aligned expectations: Balancing commercial outcomes, payer price and access expectations, and clinical trial design and outcomes early in the development process supports complete alignment between manufacturers, payers, healthcare professionals and patients. For manufacturers, internal alignment on multidisciplinary approaches to market access should combine specific global and local price and access goals, overarching commercial goals, and a robust understanding of the access landscape and positioning expectations.

- Value definition: Securing optimal price and access in a competitive market requires clear product differentiation and communication to stakeholders. This could include positioning within treatment paradigm, understanding value from an unbiased perspective or determining an option that encapsulates pricing, contracting, reimbursement and affordability.

Based on our experience and research, GPI encourages ‘starting with the end in mind’ approach to the application of best-in-class market access execution. This approach combines continuous adjustment based on market monitoring, aligned goals, and scenario-based thinking with consideration of trade-offs in pursuit of sustainable, profitable market access.

Utilising R&D to drive change

Despite the challenge to operationalise market access, the shift in technical advances and general need for better efficiency and effectiveness is a key driver for change. GPI has invested in R&D to develop innovative techniques to overcome this challenge. Research highlighted that value and price assessment frameworks necessary for outcome forecasting require adaption by therapeutic area and indication due to differences in evidence needs, degree of unmet need, competitive intensity, and country/payer archetype. It is also important to adapt frameworks around evolving payer policy and systems to ensure future perceptions are captured. For example, understanding how the joint HTA process for EU could impact price, access success, timelines, and strategy.

The integration of price and market access assessment earlier in the development process, i.e., at disease opportunity assessment to determine ideal asset selection, provides indicators of asset viability and is a potential predictor of launch success. In particular, understanding of potential price and access barriers early in the development process alleviates risks sooner. Using a technology and data driven approach based on solid value and price assessments to predict price and access outcomes throughout the life cycle process, as early as Phase I, provides manufacturers sufficient room to adapt market access strategies and course correct ahead of key decision stage gates.

Using rapid value assessment and price prediction to create sustainable access to medicines

GPI’s latest offering, GPI horizon, encapsulates this approach. Using the latest technology and robust data sources, it delivers rapid value assessment and price prediction. GPI horizon provides an analytics-powered, agile solution for value and price assessment unlike any other on the market. Backed by award-winning analytics and years of research, GPI horizon optimises your price and access strategy with transparent and robust results that you can be confident in.

Utilising the ‘starting with the end in mind’ approach, GPI have delivered a platform solution that enables a faster, data-driven approach to pricing and access research. Clients are able to understand their asset’s position in the market and weigh up several Target Product Profile (TPP) scenarios simultaneously, while the agile nature allows for clients to adapt quickly to landscape changes, throughout the asset timeline.

GPI delivers innovative price and market access solutions through agile work streams, adapting technology and services to respond to market trends. GPI’s investment in R&D has led to an expanding portfolio of technology-based solutions, centred around robust, reliable data. Now that data and inhouse market access expertise has been transformed into one integrated platform, GPI horizon.

About GPI

GPI is a price and market access insights company, providing innovative approaches to the biopharma industry. Headquartered London, GPI utilise analytical approaches to provide evidence-based decision support, helping clients to make better investment decisions.

GPI’s suite of technology and bespoke service offerings are powered by GPI pulse™, a solution that harnesses the power of technology, data, and collective expertise to produce rapid insights. The team of market access professionals, pharmacists and data specialists leverage the technology to create truly bespoke price and market access strategies, saving clients hours of paid consultancy.