Confidently estimate product prices and ensure market access

Use GPI’s value-based models and rapidly access payer and market value, helping you optimally position your asset for commercial success.

Portfolio strategy and prioritisation

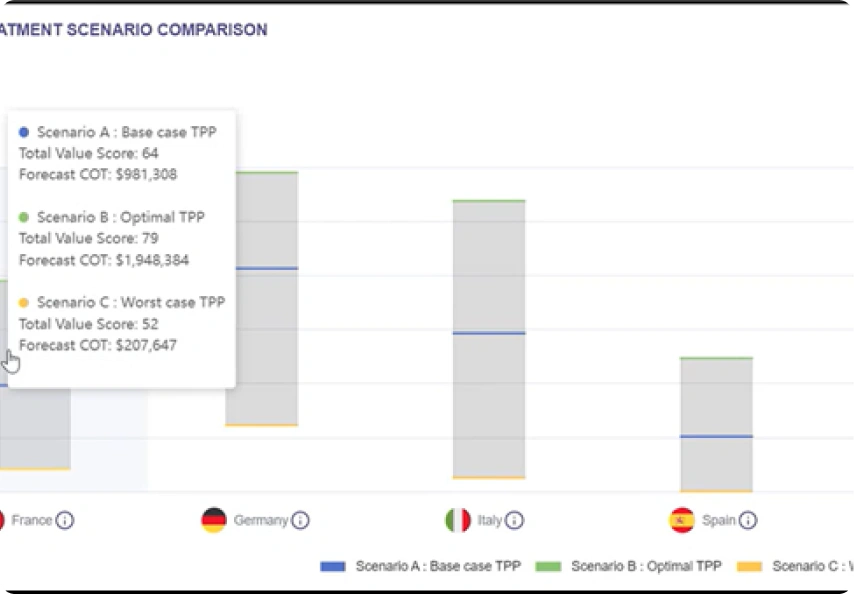

High-level comparison of your product versus analogues or comparators. Weigh up several TPP scenarios and see indication-specific price comparisons.

Investment decisions for products

Detailed insights into how payers perceive each value driver. Lower the risk of new drug launches by determining the optimal TPP across multiple indications.

Strategic price and access planning

Identify gaps for evidence generation to support differentiation and positioning at launch. Identify evidence-based opportunities for price premiums.

Price revisions throughout the product lifecycle

Best and worst-case price potential for each product based on payer-validated value drivers. Quickly re-evaluate price and adjust your strategy amid an evolving landscape.

Experience our platform

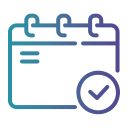

Estimate product price versus analogues and comparators

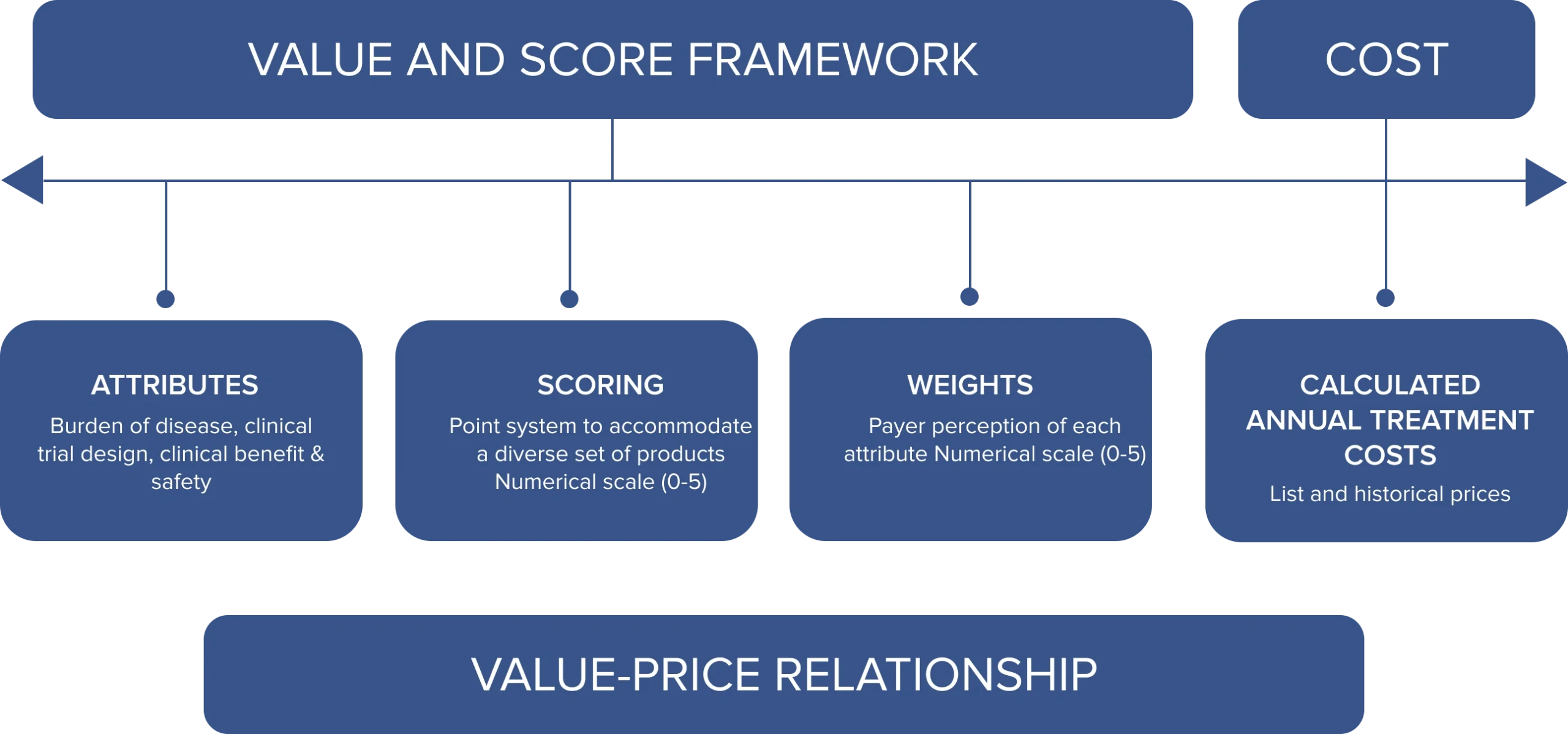

GPI’s value-based pricing methodology predicts price for your target market. Estimate the price potential versus comparators or similar analogues.

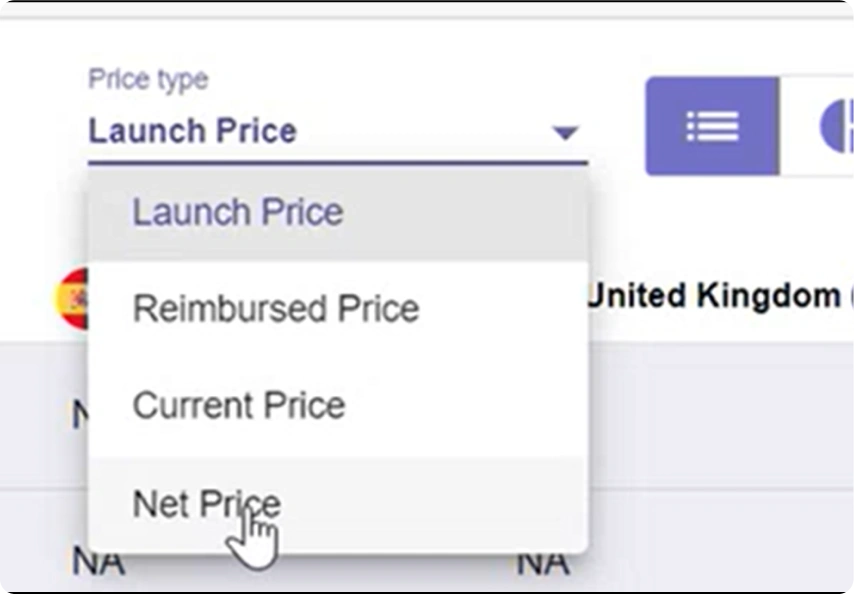

Access pricing across the product lifecycle

Including net price assumptions, or add your own known actuals (securely, with encryption and guaranteed data privacy).

Compare price scenarios in each market

See pricing estimates for key TPP scenarios defined by you.

Easy analogue / comparator identification

Find similar products by tuning product parameters.

Fast competitive intelligence

Review in-depth analysis of HTA and regulatory data mapped to each payer value driver.

Rapid insights

Compare scenarios using your product’s TPP and each payer’s perceived value. Quickly identify your gaps.

Quick price forecasts

Estimate prices based on TPP, payer perception and market conditions.

Case Study: Pricing Accuracy Using Value Based Methodologies

The inherent differences across markets is investigated in this study, an ISPOR Research winner. We analysed hormone-relapsed prostate

cancer drugs and forecast the price as it related to value in England, France and Germany using a value framework approach.

What makes GPI unique?

Our proprietary methodology

GPI's unique blend of data, technology, and expertise is unmatched in the market.

We’ve already done the research

Our multi-criteria analysis has been validated with payers in each market, confirming its accuracy of payer decision-making across orphan, oncology and chronic diseases.

We understand payer value

Our in-depth analysis of each analogue or comparator provides a standardised view against each payer value driver. Combining payer value with price delivers a value-based price forecast for any scenario modelled, reducing the need for primary research.

Evidence led

Our pricing methodology is evidence-based, with primary sources linked for verification. Each payer value driver is mapped to HTA and regulatory data, so you can make market assessments with confidence.

Talk to an expert today

Our qualified market experts can help you optimise your plan.