01 February 2024

The increase in use of multi-indication immunotherapies across a range of disease areas, has resulted in many of our clients facing the current challenge of understanding how indication expansion (both of their product and competitors) can impact the drug price.

This challenge is even more pertinent to clients who are launching in markets which either use comparator pricing or price benchmarking. For example, in Germany in can often be foreseen years ahead of launch that a product will be assigned a no-additional benefit rating by the Gemeinsamer Bundesausschuss (G-BA) if it does not meet certain criteria (such as no Phase III data) and as such, will be priced at 10% lower than the most economical comparator. Therefore, in these markets the key to understanding the likely launch price of your product lies in understanding the level of price erosion amongst the potential comparators.

Our Research

Predicting drug price erosion in Germany associated with indication expansion, to understand the potential launch price benchmark for a new product.

Our research, presented at ISPOR, examined this challenge in greater depth using analogues to understand the level of price erosion in Germany. Germany was selected given the greater transparency between list and net prices which results in frequent updates to a product’s list price.

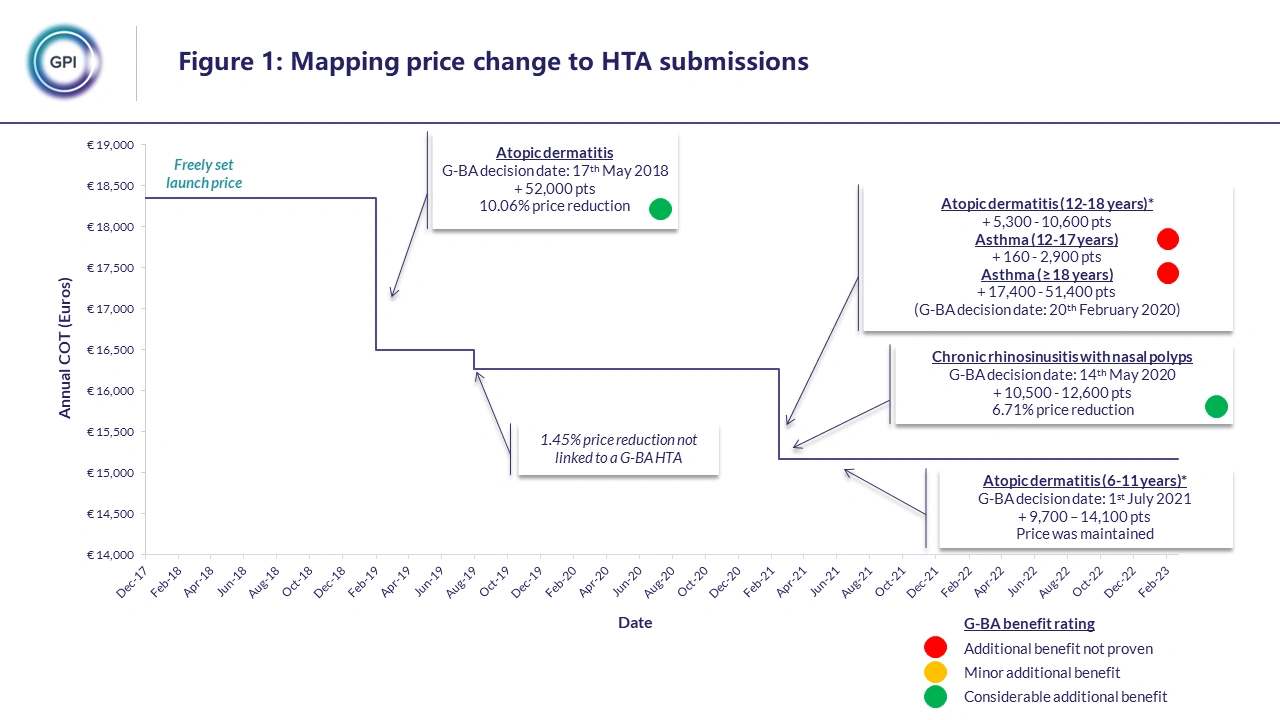

Through examining the changes in analogues list price and aligning these with historic HTA submissions (see figure 1), we were able to identify the following key drivers of price change, drop from free pricing, size of population increases and G-BA clinical benefit rating. G-BA benefit rating was found to be the main driver of price change with products receiving a considerable additional benefit rating for new indications more resistant to price erosion versus those receiving additional benefit not proven. The size of the population increase was also found to positively correlate with the level of price erosion, with greater increases in population size leading to larger reductions in price. The drop from free pricing was often the largest single price reduction for a product and however this was not incorporated into the price erosion model as we were interested in calculating the rate of price erosion following the initial drop from free pricing.

The price erosion model, using the data obtained from the analogue analysis, was able to predict the level of price erosion experienced by three comparator products. Therefore, using the price predictor we are able to provide price corridors for treatments launching in markets which use price benchmarking and to predict the level expected price erosion for products with multiple upcoming launches. The team at GPI are looking to consistently update and improve our models and the next step for our model is to incorporate net price assumptions and to broaden the data pool for the analogue analysis to further validate the assumptions.

If you are interested in our research presented at ISPOR then please download our award-winning poster “Predicting drug price erosion in Germany associated with indication expansion, to understand the potential launch price benchmark for a new product” available at the link here.

If you would like to discuss research with us in greater depth or how it could be applied to your own situation, please do not hesitate to contact us.

See more here or connect with us at info@globalpricing.com.