21 March 2024

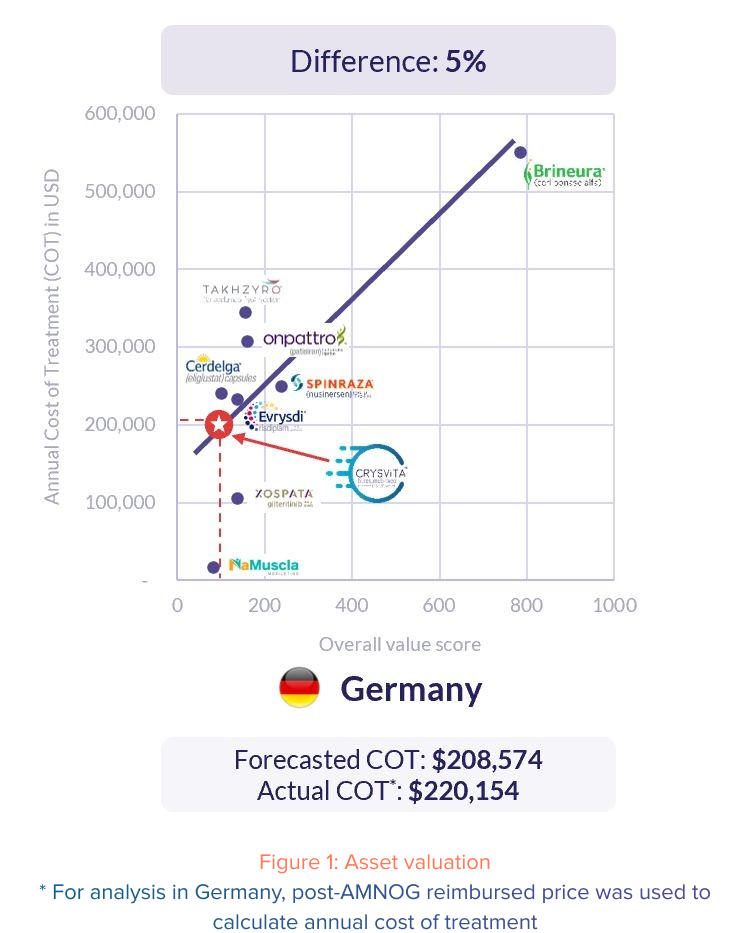

Previous research conducted by GPI demonstrated that analogue selection for value-based forecasting has shown high accuracy in predicting price. We wanted to explore the possibility of achieving higher accuracy and robustness through machine learning models and polynomial regression using larger datasets.

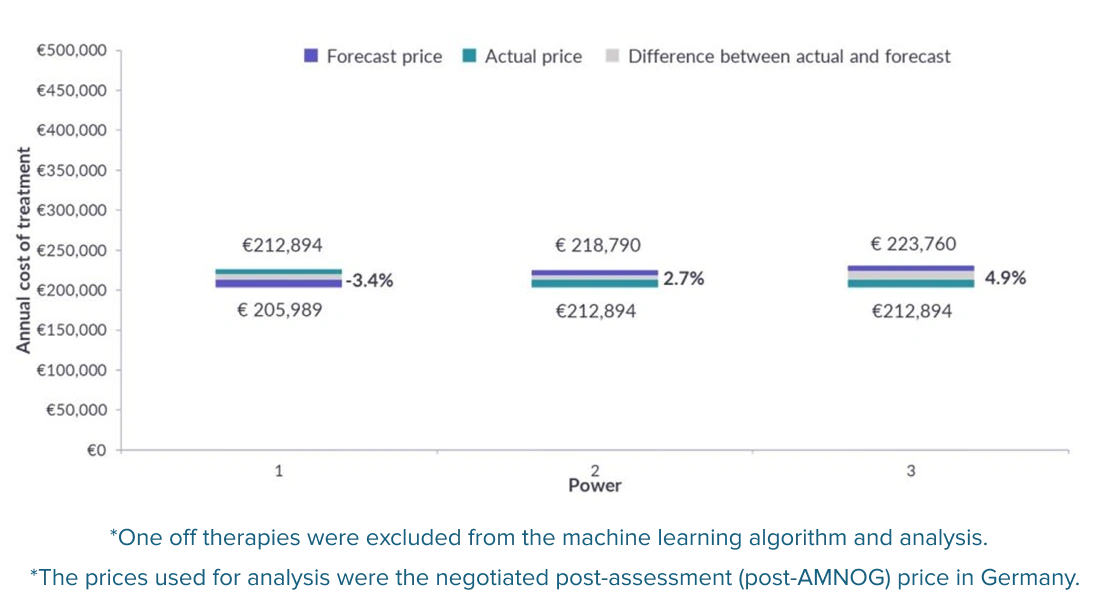

In this research, we looked at linear and polynomial models built using a larger dataset which demonstrated high accuracy in predicting the prices of burosumab, eliglustat and blinatumomab in Germany.

Our findings indicate that linear and polynomial models (degrees 2 and 3) using a larger dataset has the potential to achieve even higher accuracy than the analogue based selection method.

As part of our research at GPI, we are constantly looking to improve our value-based pricing methodology and models to best reflect payer decisions.

GPI delivers rapid value assessment and price prediction

The orphan value framework for Germany covers several value attributes within four key domains that aim to reflect payer decision-making.

As part of our library of analogues used for analysis, there are several value attributes scored for each of the analogues that fall into 4 key domains: Burden, Product characteristics, Trial design and Clinical benefit.

Burden

The patient, societal and treatment burden and potential unmet need considered as part of payer decision-making for a new product

Product characteristics

The features of a new product and the associated indication considered as part of payer decision-making

Trial design

The setup and methodology of a clinical trial providing evidence for a new product considered as part of payer decision-making

Clinical benefit

The perception of clinical trial results for a new product that will be considered as part of payer decision-making

The total value score assigned to an analogue aims to reflect the value of that product.

Analogue selection for value-based pricing and forecast

Previous research by GPI demonstrated that analogue selection for value-based pricing using a linear regression provided high accuracy in predicting the price of an orphan asset. We wanted to explore the possibility of achieving further improvement in accuracy and robustness through machine learning models and polynomial regression using larger datasets.

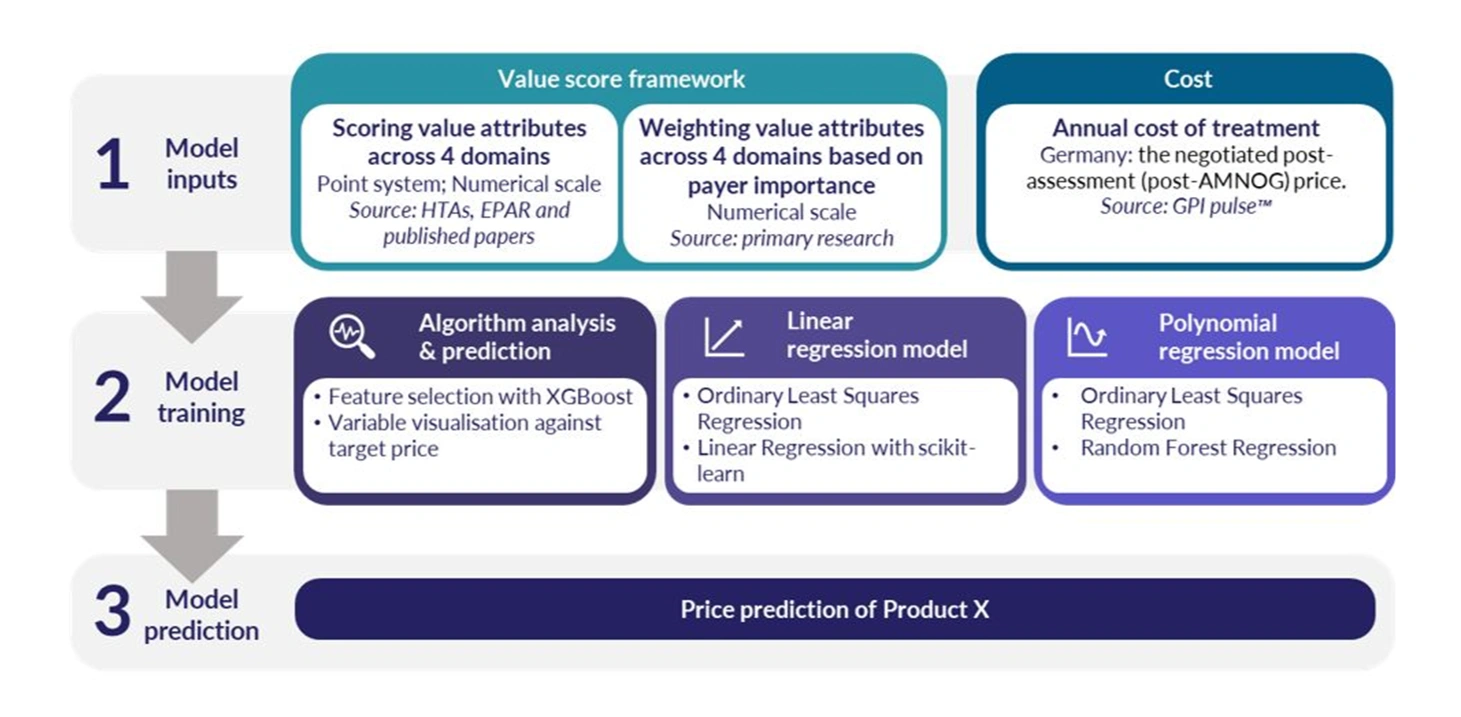

Methodology

The methodology includes three main steps:

- 1. Collating model inputs

- 2. Model training

- 3. Model prediction

*One off therapies were excluded from the machine learning algorithm and analysis.

*The prices used for analysis were the negotiated post-assessment (post-AMNOG) price in Germany.

Using this methodology, we explored the potential of linear (Power=1) and polynomial (Power= 2 and 3) models using larger datasets in predicting the price of burosumab, eliglustat and blinatumomab in Germany.