08 February 2023

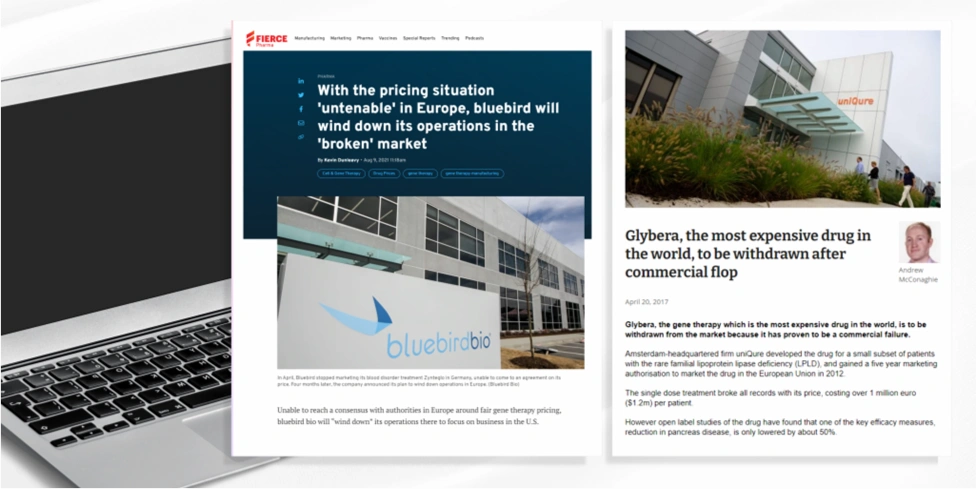

Let’s take this recent-ish example of misalignment in the case of BlueBird Bio and Zynteglo, the one-time gene therapy treatment for beta-thalassemia.

Here Bluebird Bio set their price at $1.8 million but were unable to come to an agreement on its price with the G-BA. This led to BlueBird Bio withdrawing Zynteglo from the whole European market citing challenges to achieving appropriate value recognition and market access.

Here Bluebird Bio set their price at $1.8 million but were unable to come to an agreement on its price with the G-BA. This led to BlueBird Bio withdrawing Zynteglo from the whole European market citing challenges to achieving appropriate value recognition and market access.

It’s likely that this decision is related to the global pricing implications if a lower price were negotiated in Germany. As a Germany is a heavily referenced market in terms of international reference pricing (IRP), its likely this was a strategic decision for commercial viability.

It’s likely that this decision is related to the global pricing implications if a lower price were negotiated in Germany. As a Germany is a heavily referenced market in terms of international reference pricing (IRP), its likely this was a strategic decision for commercial viability.

What is GPI’s insight on the current state of cell and gene therapies (CGT)?

- Our analysis on cell and gene therapies revealed that the average price payers accepted for orphan CGTs was way higher than for oncology or non-oncology CGTs.

- The average price was over €1M across France, Germany, Italy, and UK for orphan CGTs, but only up to an average of around €300K for non-orphan.

- The reason why payers were able to accept higher prices were because of high research and development (R&D) costs, little or no competition available, small population and high unmet need.

- In addition, some markets have the infrastructure to incorporate innovation in their HTA (health technology assessment) process, which benefits CGTs – like France, Italy, UK. But for Germany, do not consider innovation as much as it does clinical evidence.

Given these challenges, particularly as the landscape moves towards more personalised, one-time treatment options and CGTs, payers have tailored their approaches to HTA.

First Launch Markets in Europe for Orphan Assets

Here we outline some examples from the first launch markets in Europe, namely, France, UK and Germany.

Listen to audio:Kate Anstee (Associate Director, Consulting | GPI) outline these examples from first launch markets in Europe.

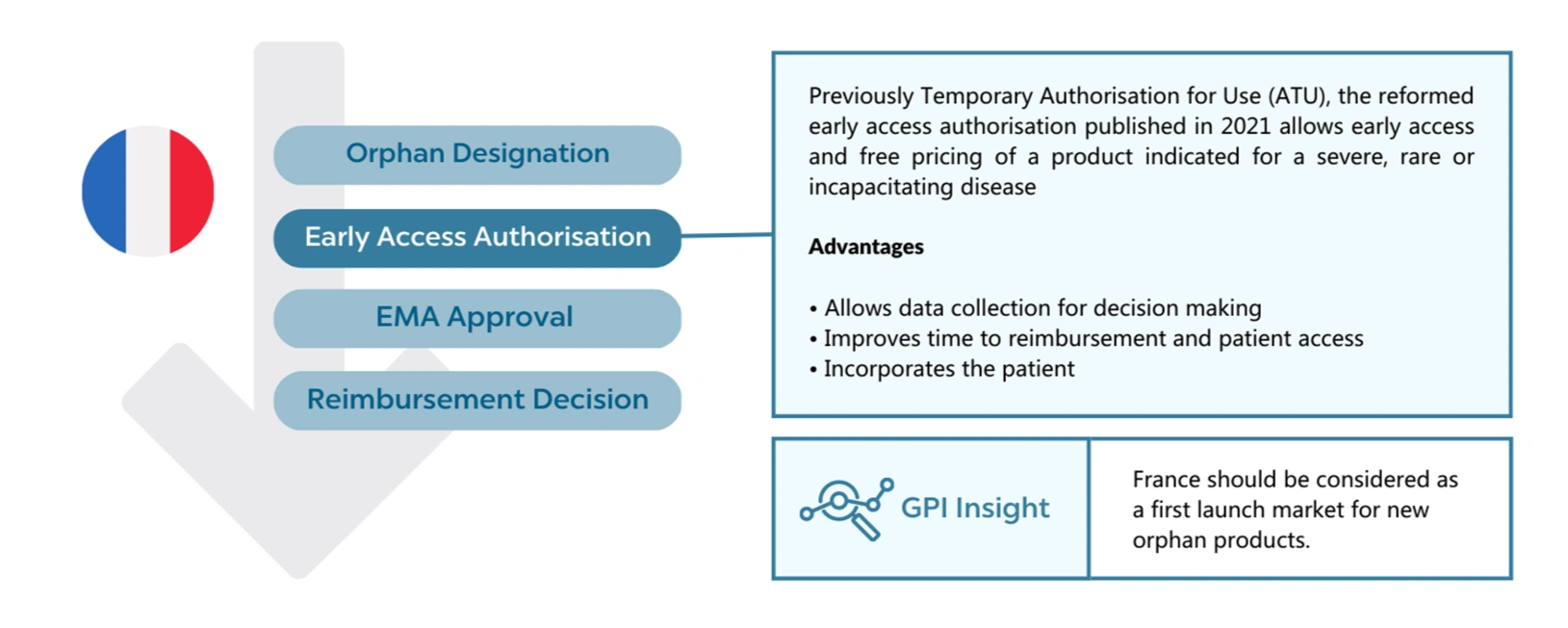

France

In France, manufacturers can apply for an early access authorisation. This was previously the ATU but has been expanded to cover non-orphan products. As a general rule, products with an orphan designation are likely to meet the criteria for early access because:

- There is no appropriate treatment.

- Cannot delay initiation of treatment.

- Presumed efficacy and safety based on the results of clinical trials.

- Presumed to be innovative, notably compared with a clinically relevant comparator.

This early access allows free pricing as with the ATU but has been adapted to meet the payers cost-containment with a payback scheme based on actual revenues rather than forecast. It also works for the manufacturer, allowing data collection as part of the scheme that can then be used to support the HTA submission. More market-specific evidence can be favourable when the clinical trial data is highly uncertain.

Therefore, for the launch strategies of new assets, the early access authorisation would make France a great first launch market.