26 July 2021

Leveraging GPI’s data and analytics platform and proprietary methodology we have assisted several of our clients analyse and define their market access strategy. In this case study, we examine how we identified the relative clinical positioning in core EU markets while defining realistic value-based price estimations within the ultra-orphan space.

The Situation

A small-sized pharma company has developed Product X for an ultra-orphan disorder with upcoming launches across key EU markets in 2021.

EU payers have fed back difficulties in seeing Product X’s value – not perceived as ‘high value’ curative treatment; therefore, defending a price premium is complex.

Due to lack of precedence in the therapeutic landscape, the company had challenges in identifying applicable analogue cases. The company had challenges in pinpointing Product X’s relative value positioning and how this can potentially be translated to a price point.

The Methodology

The Solution

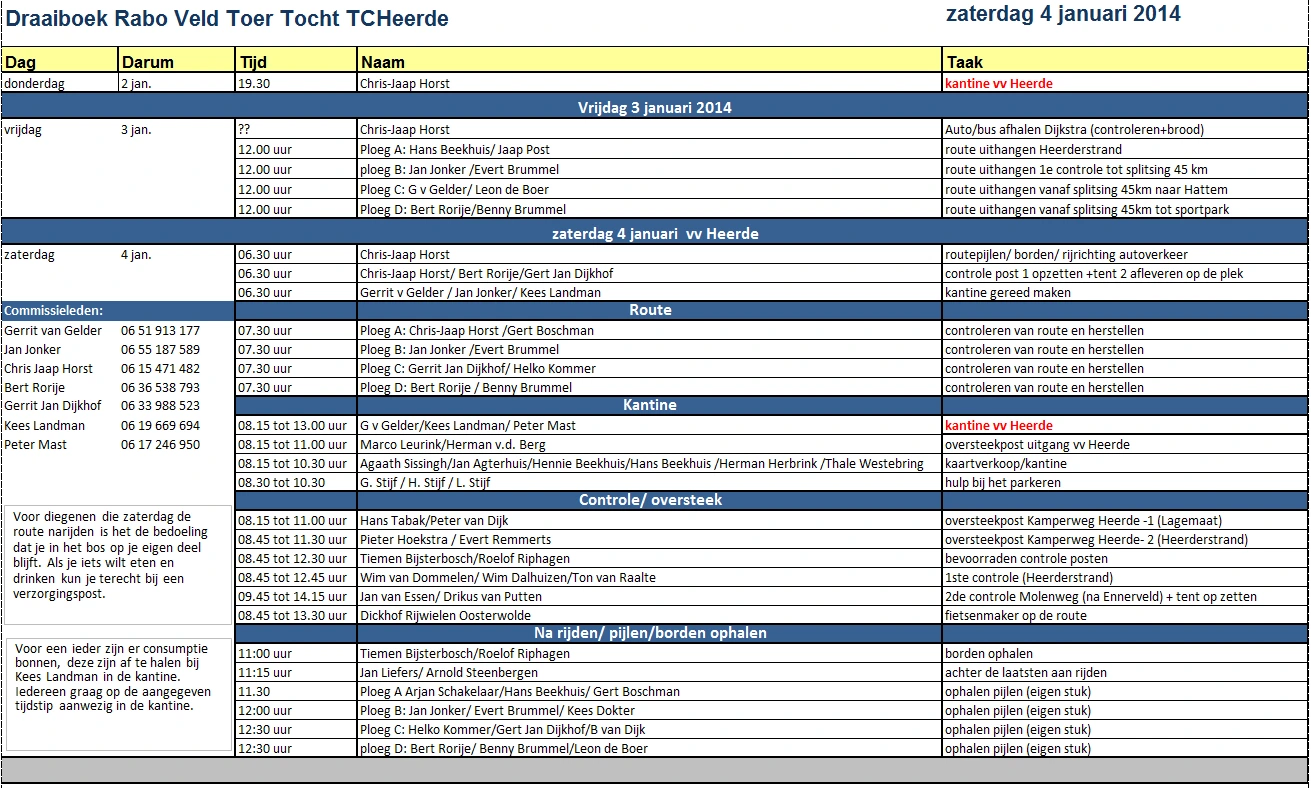

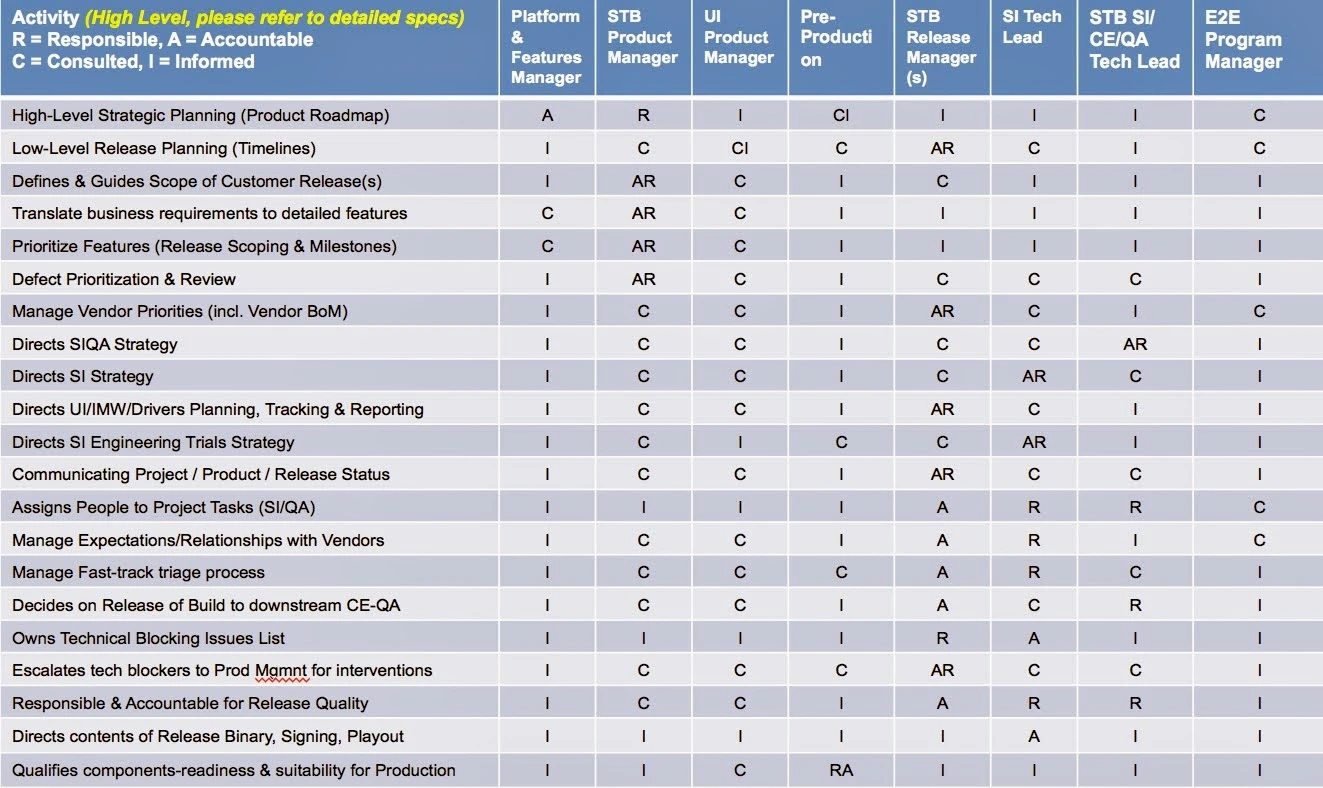

GPI identified key value drivers considered by payers during HTA across major EU markets within the rare disease space.

Our analysis demonstrated considerable correlation between value and price within all markets in scope; providing a reason to believe that value-based pricing may no longer be a theoretical concept across EU.

Findings, alongside other parallel research was socialised with internal company stakeholders at the company to strengthen value positioning defence in external negotiations and also inform pricing strategy.