15 February 2022

The current administration has once again stalled at successfully passing legislation that could directly tackle elevated drug prices in the US. In this case, the Build Back Better (BBB) package along with the drug pricing policies within it seem to have hit a road block in the Senate. According to the Congressional Budget Office (CBO), the drug pricing provisions in BBB could have generated savings for the government of $160 billion over the next decade by allowing Medicare to negotiate drug prices, and capping drug prices increases to the rate of inflation. However, in the absence of federal reforms, GPI continues to monitor individual states as they advance new laws to cut down on drug spending.

State Drug Pricing Laws

Although state drug pricing policies vary widely from state to state, they generally fall into one of five categories – Pharmacy Benefit Manager (PBM) oversight/reform; Drug Pricing Transparency; Drug Importation; Pricing Boards/Affordability Reviews; and Coupon/Cost sharing reform. Between January 2017 and October 2021, the National Academy for State Health Policy (NASHP), estimates that around 211 state laws have been enacted across the US targeting drug prices.

| State Drug Pricing Laws 2017-2021* | |

|---|---|

| Pharmacy Benefit Manager | 111 |

| Drug Price Transparency | 25 |

| Importation from Canada | 8 |

| Pricing Board/ Affordability Review | 6 |

| Coupons/ Cost Sharing | 26 |

| Other | 35 |

| Total Laws Enacted | 211 |

| Number of States | 49 |

| Source: GPI adapted from NASHP data, 2022 *data collected until 14 October 2021 |

|

While PBM oversight and reforms represent around 52% of the total number of state laws enacted between 2017 and 2021, drug price transparency has been steadily expanding to at least 25 laws in around 2 dozen states since Vermont became the first state to enact a transparency law back in 2016.

Source: GPI adapted from NASHP data, 2022

Drug Transparency Reporting

The new transparency laws often mandate manufactures, PBMs, insurers, wholesalers or even pharmacies to disclose drug costs at various points of the value chain. Reporting requirements are sometimes attached to drug pricing legislation focused on PBM reforms/oversight, and have also been part of laws establishing prescription drug affordability boards (PDAB). These pricing boards generally have the authority to review prices for high-cost drugs and potentially set a price cap.

Some states focus transparency reporting on a smaller list of the top-spending drugs that have had their list prices increased by a certain amount, or if a drug is introduced with a high launch price. While others have expanded reporting requirements to include a much larger data set. For example, Nevada now requires manufacturers to submit pricing data for any products with price increases of 10% or more per year, if they have a wholesale acquisition cost (WAC) exceeding $40 for a course of treatment. Maine’s requirements include pricing data for all products within the same drug product family as another product that triggered reporting requirements (ie. price increase exceeding 20%).

Transparency requirements are here to stay

State drug pricing policies are likely to continue to expand, particularly as they seem to be yielding some success for the states that have implemented them. Vermont recently reported that there was a 79% decline in the number of drugs exceeding the 15% annual price increase threshold between 2016 (when the new law was first implemented), and 2020.

The variability of reporting from state to state however adds a notable burden on manufacturers that have to keep track of all the different requirements, and ensure cost of treatment (COT) calculations for monthly or annual WAC for each of their products is accurate and standardized, particularly if they have a large portfolio of drugs for which they need to report pricing information. Monitoring state legislation and ensuring reporting requirements are met is becoming a key consideration for pharma, particularly as there seems to be no consensus in Congress on a national solution.

GPI and State Drug Price Transparency Reporting

GPI is uniquely positioned to help clients satisfy all legal data requirements for State Drug Price Transparency Reporting with our data analytics platform, combined with our team of pharmacists and data specialists. GPI use a tailored approach to create accurate datasets, incorporating preferred business rules and dosing assumptions, with the flexibility to adapt to each state’s reporting requirements.

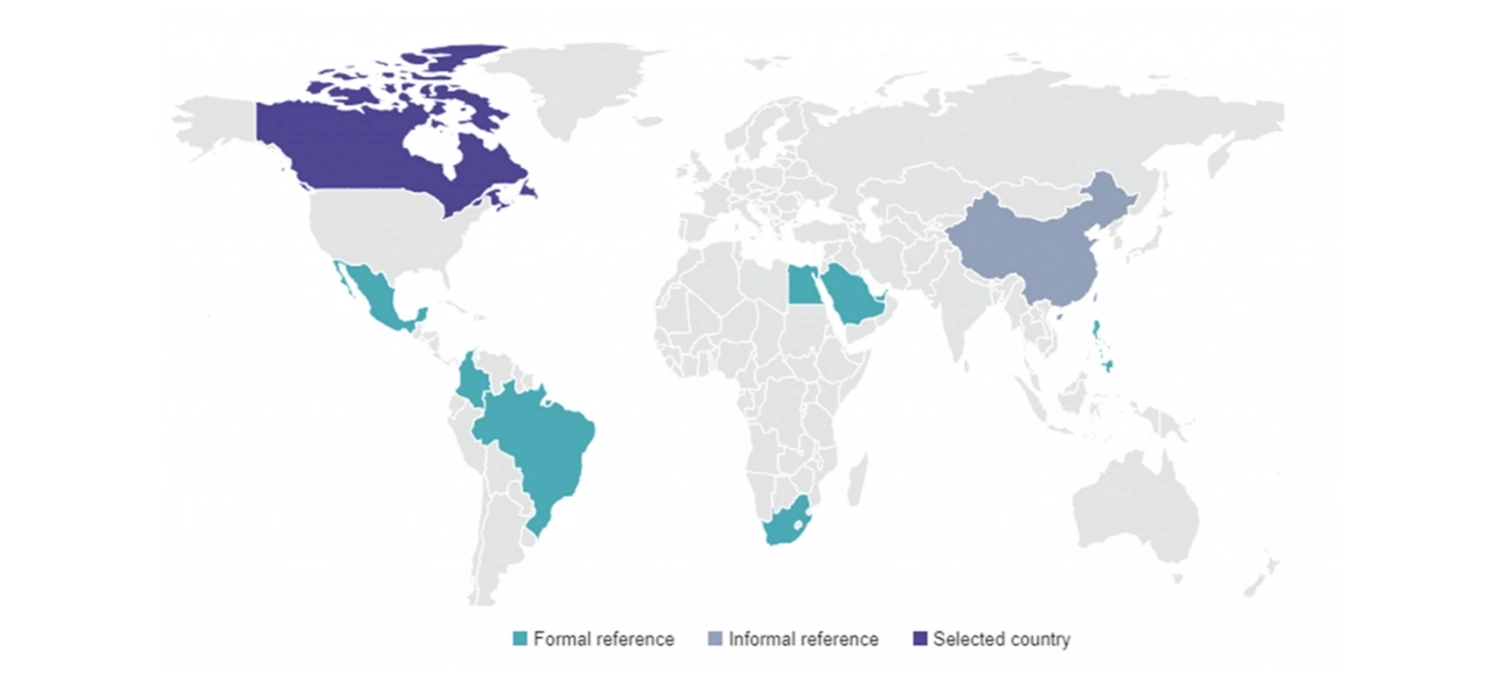

Having developed a systematic methodology for COT calculations in the USA and across 90 global markets, GPI’s industry-leading data standards and team of experts help clients save time and resources, remove operational burden, and ease the process to be compliant with new state legislation.

You can find out more about GPI’s data and methodology and how we can assist with State Drug Transparency Reporting by speaking with one of our consultants.

By Margaret Labban, PhD, Pricing & Market Access Solutions Manager, Global Pricing Innovations

Have a question for our experts?

Submit the form and one of our experts will contact you.