17 May 2021

GPI supported a large biopharmaceutical company in forecasting their early-stage assets.

The Situation

Our client, a large biopharma company sought to:

- understand two early-stage assets’ developmental vs. commercial trade-offs in various oncology indications

- profile past deal profiles for oncology assets to gain insights into potential out-licensing options

The Challenge

The company was not established in the oncology space and so lacked expertise in asset optimisation:

- Rationale behind target indications was not clear and commercial viability not always taken into consideration

- Deal benchmarking had not been thought through thoroughly and options to out-license weren’t clear

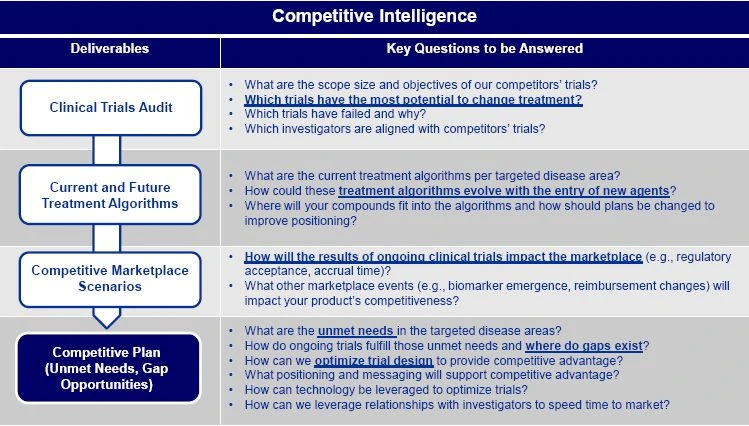

- Methods to monitor the oncology landscape in terms of changes to the SOC, price benchmarks and preparation for conferences (e.g. ASCO) were not developed yet

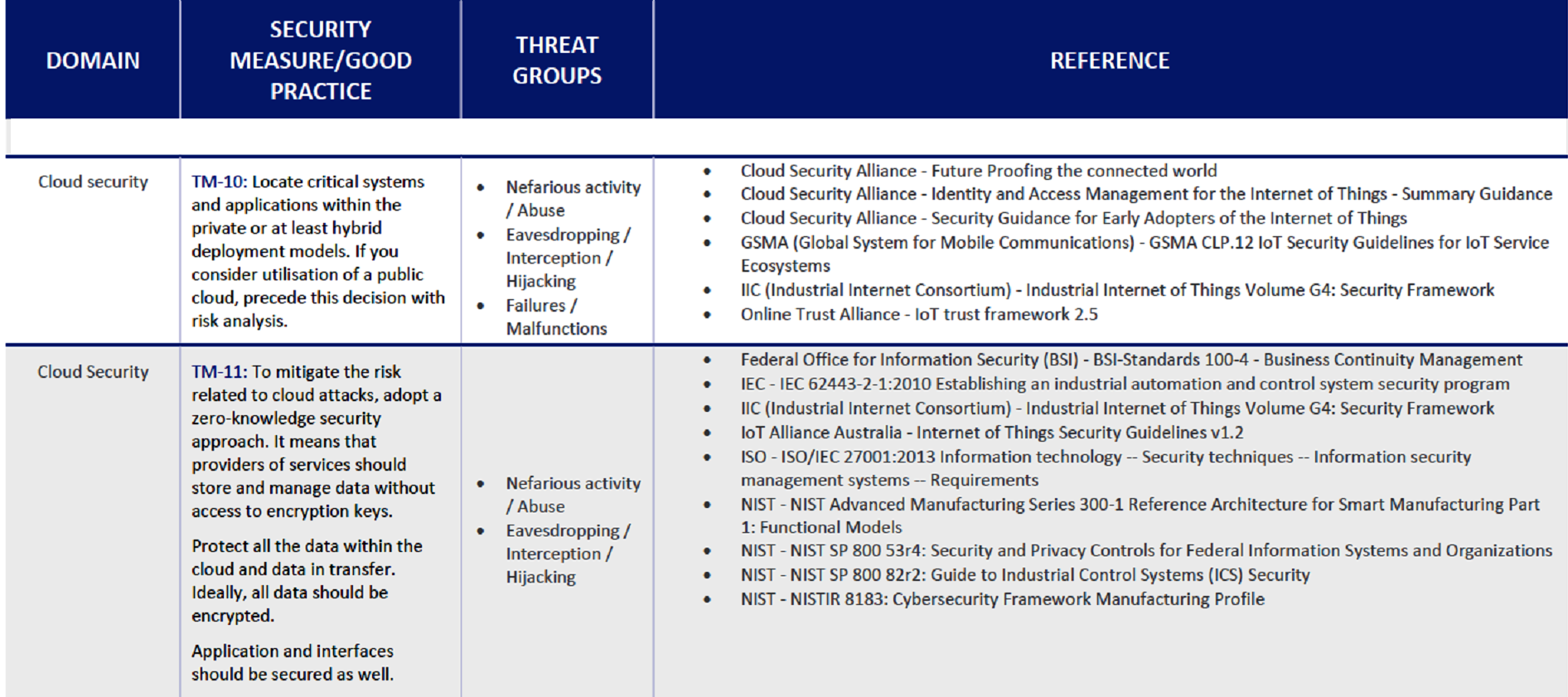

The Methodology

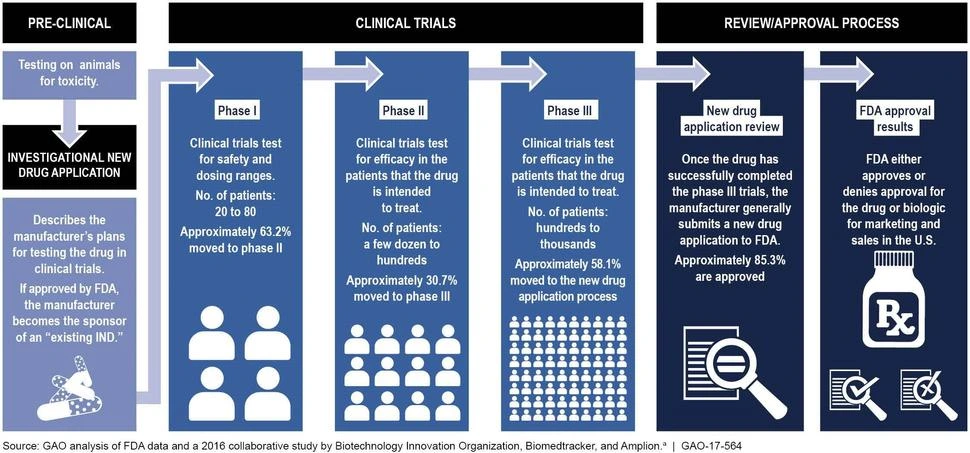

Unmet need value framework & price potential

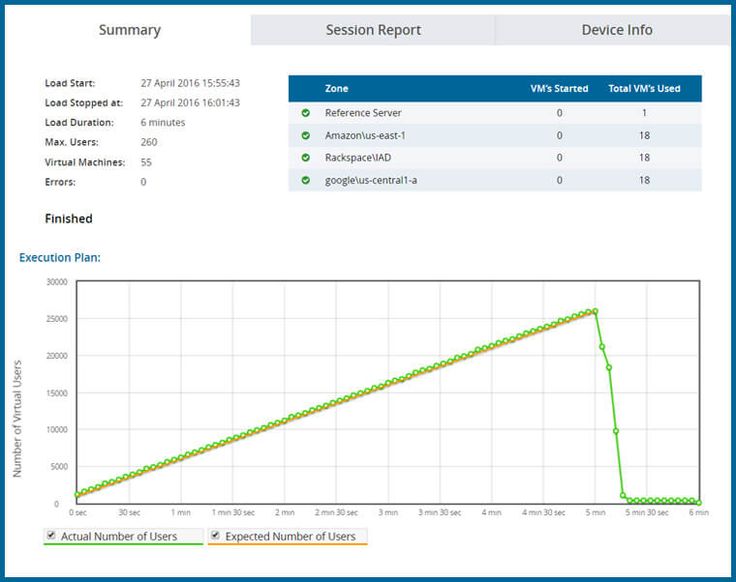

Target patient population & revenue forecast

Analysing deals & building analogue deal profiles

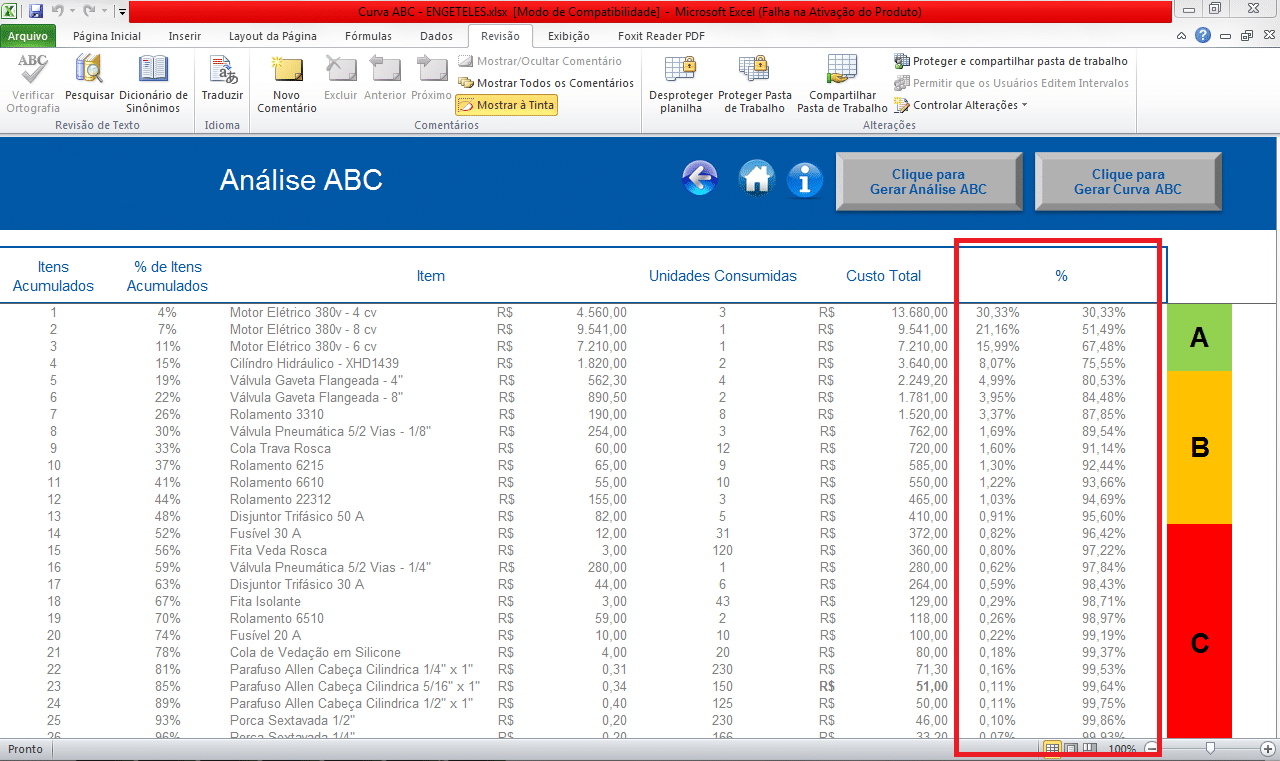

Monitoring pipeline competitors & anticipating change to SOC

The Solution

GPI enabled the client team to derive the price potential for their two assets in various oncology indications and forecast revenue using defined target populations. Profiling their assets’ using deal benchmarks provided them with options around deal outcomes and values.

Finally, GPI’s ability to monitor the oncology landscape through internal expertise and our platform, has meant the client is supported throughout the ongoing development of their assets.