27 July 2022

GPI methodology

GPI has developed a proprietary state-of-the-art methodology that assesses the potential price and value of an asset by leveraging analytics and adaptable frameworks to mimic payer decisions. It centres around the concept that an asset’s price and access potential are linked to its perceived value, which differs across markets. One of the key results of the methodology, is accuracy of price forecasting.

Utilising GPI horizon for price forecasting

GPI used the horizon methodology to develop a case study forecasting drug prices for reimbursement in hormone-relapsed prostate cancer. This study assessed the value-price relationship of products in this indication in England, France and Germany. The research was presented at ISPOR US 2022 and was awarded the‘Best New Investigator Poster Research Presentation‘.

Applying GPI forecasting in oncology

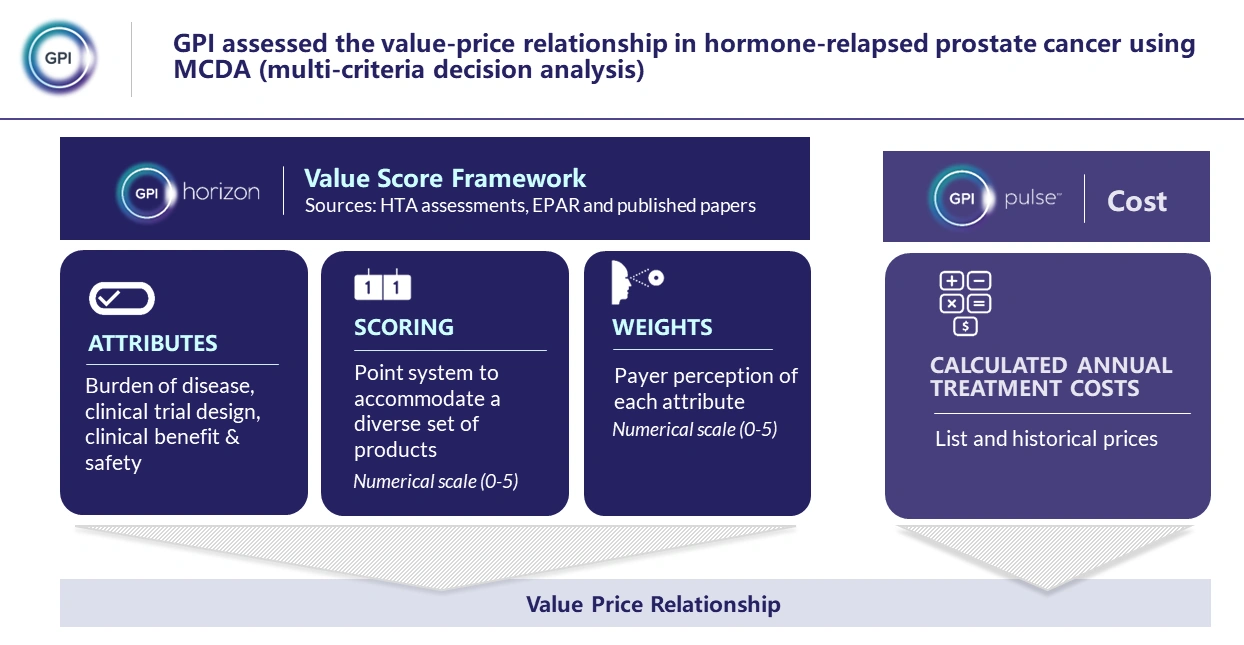

A multi-criteria decision analysis (MCDA) value scoring framework was established for a selection of high-cost oncology products, based on payer decision-making in the context of HTA assessments. Market-specific framework attributes were captured based on HTA guidelines, published literature and GPI internal information (Figure 1).

Figure 1 Main components of the value framework methodology.

The case study’s asset of focus, darolutamide, and a list of its comparators in hormone-relapsed prostate cancer (abiraterone, enzalutamide, and apalutamide), were scored within the value framework.

To investigate the value-price relationship and forecast pricing of darolutamide, value scores were plotted against annual cost of treatment (CoT) using list prices for each product in France and Germany, and QALY gain in England. The price forecasting results were validated by comparison to actual list prices of darolutamide.

Results demonstrate the accuracy of price predictions across divergent markets

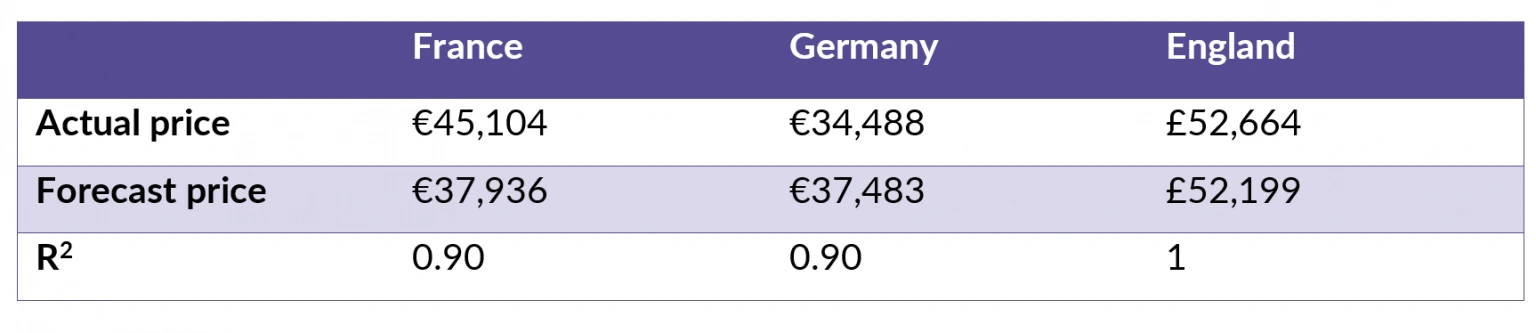

The analysis suggests a strong correlation between value assessment and the given list price or QALY gain across all the markets assessed (table 1). In England, based on the value score and QALY regression (R2=1), the forecast QALY gain (1.69) was used to further calculate a forecast price for darolutamide. In Germany, the post-AMNOG price was used.

Table 1: GPI horizon results in prostate cancer.

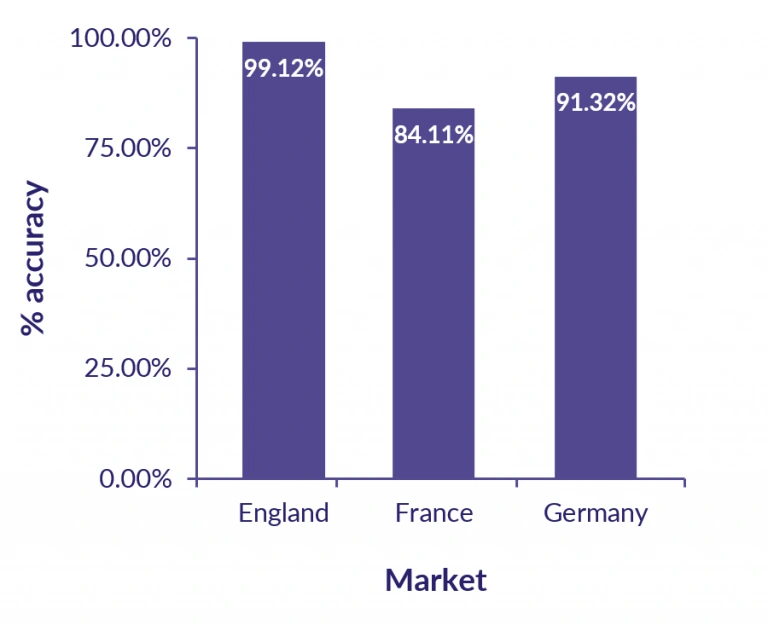

Across England, France and Germany, an average accuracy of 91.51% (84.11% – 99.12%) was observed for the forecast price of darolutamide vis-à-vis the actual price.

Figure 2: GPI horizon accuracy in prostate cancer

Putting the results in context

The results highlight the power of the Horizon framework as a tool for product price planning and supporting payer discussions. The analysis demonstrates the ability of the Horizon methodology to accurately forecast the launch/post-AMNOG price of a new product by establishing both the value-price and value-QALY gain relationship for products within prostate cancer.

The regression cannot be considered in isolation. Country-specific HTA frameworks must be considered when interpreting these results. In countries which do not rely on the QALY (France and Germany), the value-price correlation is closely aligned. However, in England, the QALY may have limitations in capturing the value of life-extending treatments for advanced disease.

NICE acknowledges that methods are evolving, and in 2022 published updated manuals for methods, processes and topic selection for HTA. This incorporates a new severity modifier to consider two different – but related – measures of disease severity: absolute QALY shortfall, and proportional QALY shortfall1. Moreover, it must also be acknowledged that in England, list prices do not reflect the confidential net prices negotiated by NICE for the NHS. As a result, in this case study, QALYs are used rather than CoT.

Keeping pace with evolving value frameworks

The ability to demonstrate value beyond the QALY is an issue which has been discussed extensively. As stated by Nancy Devlin, past president of ISPOR, there are several issues with using the QALY to estimate value in oncology2:

- limitations with the generic PROs currently used as a basis for estimating QALYs

- takes no account of patients’ preferences with respect to the ‘process of care’

- there may be wider benefits to society from oncology treatments.

Furthermore, IQWiG – the German HTA body – has historically noted that cost per QALY is not a real “methodological standard”, and whether QALYs should be used involves ethical, legal, and cultural considerations3.

For the researchers and consultants at GPI, this issue is at the forefront of our thoughts. We continue to assess different ways of forecasting price and value, both within and outside of countries which use the QALY.

References