15 February 2024

Overview

As manufacturers continue to face downward pressures on drug prices, new and innovative ways are needed to estimate asset prices. Value-based models can support manufacturers to determine payer validated price corridors and understand how price premiums can be justified based on value.

In this research, we explore a real-life example of how a value-based model can support market success using GPI’s horizon methodology. We also explore the impact on the price potential of the asset following an increase in asset value

Background

Downward pressures on drug prices remains a challenge as payers continue to face constrained healthcare budgets. In parallel, more and more innovative orphan drugs are being developed, with high research and development costs. So how can manufacturers objectively estimate a payer acceptable price and cover their costs? How can manufacturers really understand how payers think when assessing an asset and to what extent do factors such as clinical benefit, uncertainty, and economic impact price? One way is through modelling the assets value against its price potential.

Methods

In this research, we used GPI’s payer validated value-based horizon methodology to assess:

- How a manufacturer can identify an objective price based on its asset value, and

- How this technique can support the value story of the asset when justifying a price premium at the payer negotiation stage.

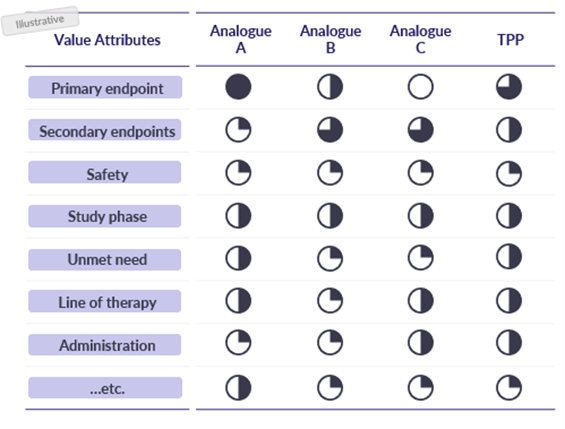

We based the research on a real-life case study for Asset X, which was an orphan asset indicated for viral infections. Asset X was valued against different payer validated factors to determine its strengths and weaknesses (Figure 1). Clinically relevant analogues were identified and evaluated for the analysis. The scope markets included the EU4 and the UK. A scenario analysis was undertaken to identify how improved efficacy and safety outcomes would affect the price potential.

Figure 1: Asset valuation

Key Insights

Using the horizon methodology, price estimates were derived for Asset X based on payer perceived value per market (see Figure 2 for an example of the base case for France). In the scenario analysis for France, the perceived payer value of Asset X increased by 17% whilst its estimated price increased by 31% relative to the base case. Using the base case and scenario analysis price points, an estimated value-based price corridor was derived for each market (see Figure 3 for an example of the price corridor for France and UK).

Figure 2: Base-case example for France

Figure 3: Price corridors for Asset X in France and the United Kingdom

Discussion

Using the value-based horizon methodology, GPI’s consulting team were able to support the manufacturer by analysing the key payer drivers of price for Asset X. The team were able to explore and explain why a 17% increase in value could lead to as much as a 31% increase in price if launched in France based on the model insights and consulting expertise. This provided the manufacturer with a better understanding of how they could potentially justify a price premium at the negotiation stage, despite not being the first to market for this indication. GPI also explored potential risks based on the assets value, which were modelled in separate analyses, though this is not presented here.

As the methodology had been payer validated, GPI were able to support the manufacturer with its early pricing assessment without the need for extensive payer interviews.

Conclusion and GPI’s impact on the industry

In an environment of rising research and development costs for innovative orphan drugs coupled with downward pressures from payers, manufacturers need to find new ways of determining price. Value-based models can support manufacturers in not only determining realistic payer validated price corridors but also support in understanding how price premiums can be justified at the negotiation stage based on asset value.

At GPI, we use the horizon value-based methodology to support manufacturers with this on a day-to-day basis. Not only do we determine the price potential of the asset based on key payer attributes but also support the assets positioning based on its added value to the market. At GPI, we use our years of pricing and market access experience coupled with model insights to assess the risks that an asset might face and explore how a company can best mitigate and reduce those risks.

If you would like to find out more about how you can leverage GPI’s proprietary data, methodology and consulting offerings, please reach out directly to our experts.