23 December 2021

China published its annual update to the national reimbursement drug list (NRDL) on 3rd December, which will be implemented from 1st January 2022. A total of seventy-four drugs entered the NRDL and eleven were removed. Sixty-seven (91%) of the drugs that were added are novel therapies reimbursed for the first time in China.

Price negotiation with the National Healthcare Security Administration (NHSA) resulted in an average discount of 62% on the list price. Here are some key takeaways from the GPI Asia-Pacific experts.

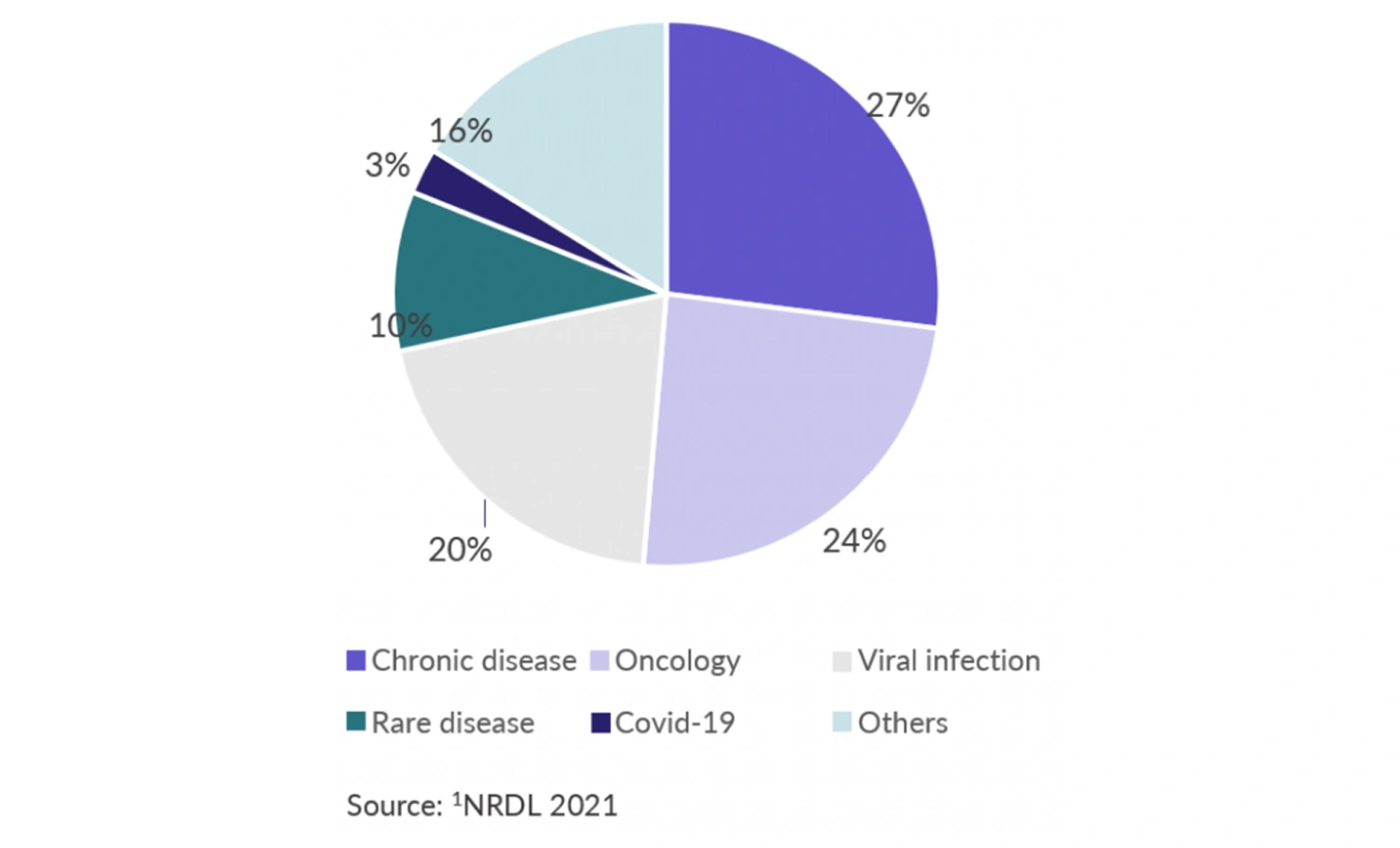

Figure 1 Therapeutic areas covered by drugs included in 2021 NRDL update1

Unmet needs for drugs in chronic diseases and oncology remain high

The seventy-four drugs entering the NRDL cover twenty-one therapeutic areas, including: 20 drugs for chronic diseases such as hypertension, diabetes, hyperlipidemia and psychosis, 18 oncology drugs, 15 drugs for viral infections such as hepatitis C and AIDS, 7 drugs for rare diseases, 2 drugs for Covid, and 12 drugs for other therapeutic areas (see Figure 1).

The NHSA recognizes the high unmet needs for drugs in chronic diseases and oncology due to China’s aging population, which was taken into consideration in the NRDL assessment and price negotiation.

Price negotiation have become compulsory and increasingly competitive, as local Chinese manufacturers create downward pricing pressure

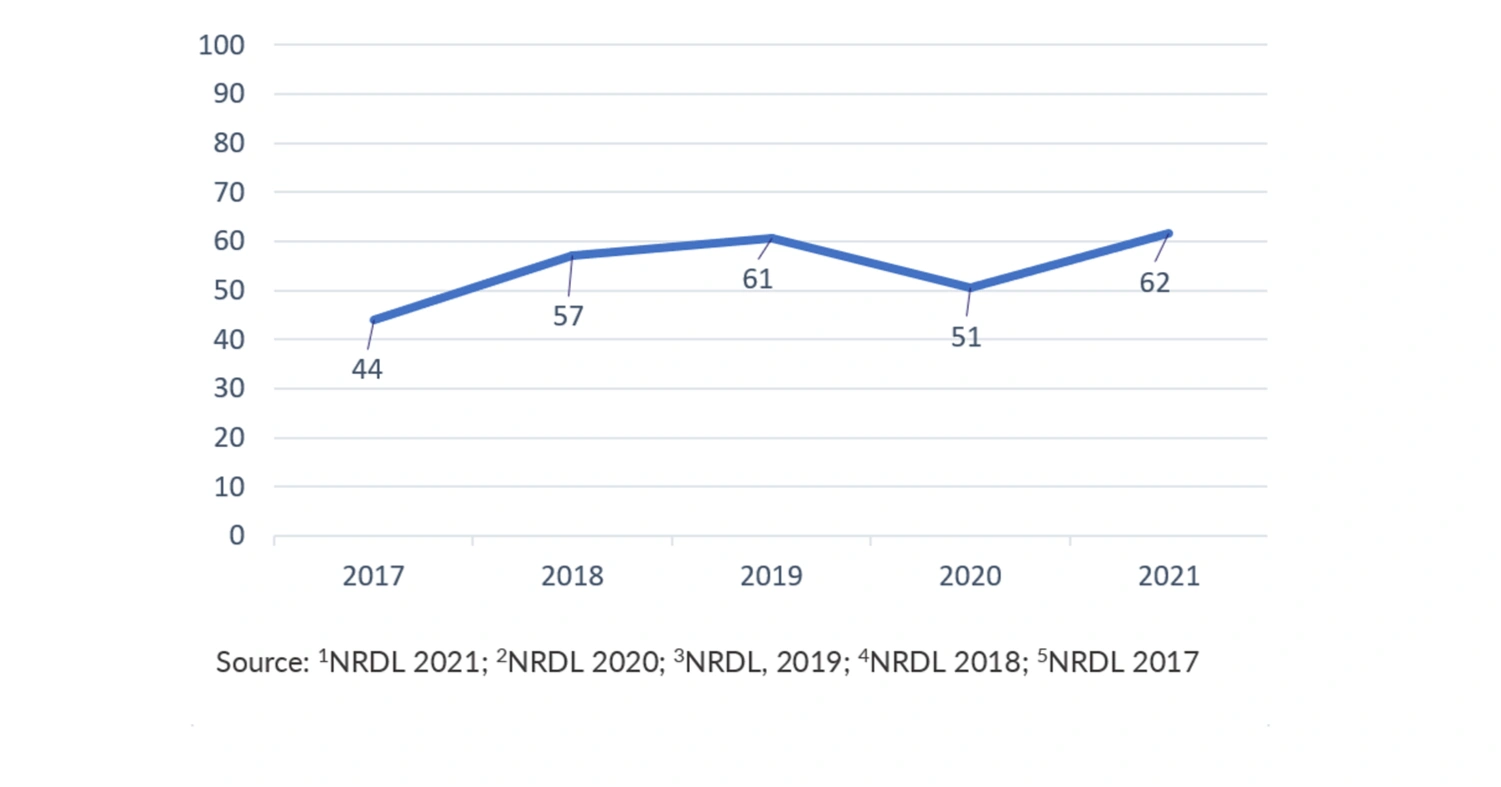

Annual price negotiation with NHSA has become compulsory for all novel treatments to obtain NRDL inclusion since 2017. In the 2021 NRDL update, eighty-five novel treatments were selected for the price negotiation, and 67 (79%) were successfully negotiated and included in the NRDL. The average discount rate reached its highest in 2021 at 62%, compared to 51% in 2020; 61% in 2019; 57% in 2018 and 44% in 2017 (see Figure 2).

Figure 2 Average price cuts in NRDL negotiations for newly negotiated drugs (%)1-5

The increase discount is especially applicable to Western manufacturers who historically set higher prices. The growing number of drugs from local manufacturers generates downward pricing pressure, and results in competitive pricing in national reimbursement negotiations for drugs with the same class or within the same indication.

The NHSA has a strong negotiation position for the with Western manufacturers because:

- regulatory reform accelerates product approval

- local manufacturers have an increased ability to bring innovative products to market, increasing the number of alternative therapies

- the NHSA encourages competitive negotiation.

Local Chinese manufacturers create access barriers for Western manufacturers

For the first time, the number of novel treatments added to the NRDL from local manufacturers exceed those from Western manufacturers. Sixty three percent of the of sixty-seven drugs included in the NRDL update were developed by local manufacturers, and 37% by Western manufacturers.

The PD-(L)1 inhibitor market can be used as a case study. PD-(L)1 inhibitor products from BMS, Merck, Roche and AstraZeneca did not enter the NRDL, while three PD-(L)1 inhibitor products from local manufacturers were successfully negotiated for multiple new indications:

- tislelizumab (BeiGene) with three additional indications,

- sintilimab (Innovent) with three additional indications,

- toripalimab (Junshi Pharma) with two additional indications

The negotiated prices of tislelizumab and sintilimab were approximately 30,000 to 40,000 RMB (4,704 to 6,272 USD) per year, and the price of toripalimab was about 40,000 RMB (6,272 USD) per year. In comparison, annual costs of PD-(L)1 inhibitor products from Western manufacturers are much higher, ranging from 70,000 to 140,000 RMB (10,976 to 21,952 USD).

In addition, patients need to pay out of pocket for drugs not included in NRDL. Locally manufactured options with a lower price will create barriers to access for drugs developed by Western manufacturers.

GPI is your go-to partner to understand market landscape and pricing and access strategy in China

NRDL inclusion is the only pathway for reimbursement of drugs by public health insurance in China. Although the barrier for NRDL assessment remains high and price negotiation is increasingly competitive, the subsequent uptake and sales growth make NRDL entry worth-while.

GPI could help you to understand market landscape and pricing and access strategy in China through:

- GPI data analytics platform:incorporates timely updates of reimbursement and pricing information for ninety countries, including China. Reimbursement status and price of the newly added drugs to 2021 NRDL will be live on GPI’s platform from 1st January 2022, aligned with the formal implementation date in China. Appropriate case study analogues can be identified through GPI’s platform to inform the price corridor for successful negotiation of the target asset.

- GPI consulting: GPI’s consulting team has extensive experiences in pricing and market access strategy in key emerging markets such as China, whose pricing and market access process and requirements are not fully transparent. Based on our regular collaborations with local payers and policy experts, the GPI team can introduce you to the country’s pricing and reimbursement system and deliver tailored recommendations for the market access strategy of the target asset