30 January 2023

Our recent webinar on ‘How To Unlock Market Access and Pricing Potential of an Orphan Drug’ assessed the landscape for orphan drugs. Here we take a deeper dive into the subject to learn more.

The orphan drug market has drastically changed. The ways in which we can treat rare diseases and disorders are expanding, which is great news for patients. In fact, 2022 may even be hailed as a pivotal year for the diagnosis and treatment of rare diseases, scientific advances, and new approval pathways. However, we start seeing an overcrowded market. We see a growing movement away from monopolies to a more competitive market with multiple products being made available within a single indication.

We ran a poll at our recent orphan drug webinar.

Poll 1:

Which component of launching an orphan drug do you find most challenging?

- Market access, (0%)

- Pricing (43%)

- Or both? (57%)

The results are interesting and here is what Kate Anstee (Associate Director, Consulting | GPI) had to say about it.

Orphan drugs account for a substantial proportion of recently approved and launched products.

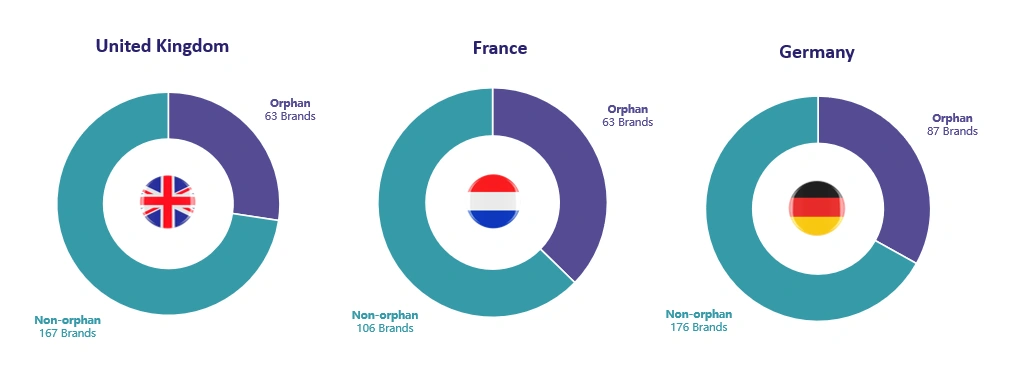

Here we have focused on three launch markets in Europe: UK, France, and Germany. Almost a third of products launched since 2016 were orphan products (UK: 27%, France: 37%, Germany: 33%). This includes 11 cell and gene therapies. *

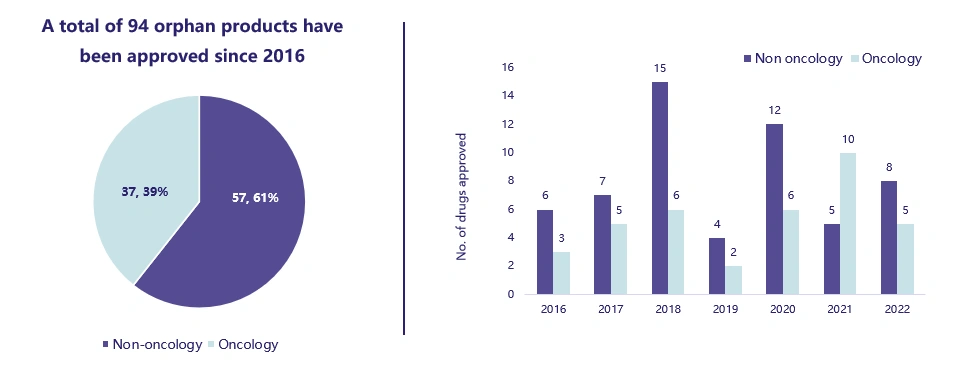

Did you know that majority of orphan products launched in the last seven years have been non-oncology orphan products?

Interestingly, most of the orphan products were approved in non-oncology indications since 2016. The most orphan products 21 (as per the chart on the right) were approved in 2018, of which 15 of these were for non-oncology indications.

GPI Insight:

It’s likely that non-oncology indications will continue to dominate orphan products.

Listen to the explanation behind this insight with this audio by Kate Anstee, Associate Director, Consulting | GPI here.

The Rise of Competition in Orphan Indications

The more the merrier? Competition is increasing in several orphan indications. Unlike the past when most orphan indications had no comparator products available, several indications now have multiple products available in the market. Our GPI data revealed that orphan indications will continue to be competitive with multiple products launching.

Kate Anstee, Associate Director, Consulting | GPI presents an example of increased competition within orphan indication.

The Orphan Drug landscape is changing and therefore payers and manufacturers need to be able to take advantage of the opportunities that are arising. They also need to be able to react quickly in order to stay one step ahead of their competitors and ensure a successful launch.

GPI’s methodology

GPI’s proprietary methodology can help you do this. GPI’s online analytics platform is an award-winning tool that has been proven effective in helping pharma find better ways to price their orphan drugs and unlock its full commercial potential.

To learn more about what GPI can do for your orphan asset, reach out to us below. You can also stay up-to-date with the latest GPI content by signing up to our newsletter.

Futureproof your orphan drug development by overcoming these four challenges.

In this audio, Rachel Jao, GPI Head of Product Strategy, discusses these challenges, solutions and impacts as outlined in the table below.

Lack of standard of care (SOC) or relevant analogues:

Challenge:

Selecting analogues for your orphan product when there is no standard of care or comparable products. This makes it difficult to do any benchmarking, and typically your competitors in the pipeline are also doing the same forecasting.

Solution

Our recommended solution is to find a way to create flexibility to expand analogue selection to other therapy areas or indications. The way we do this is by using our value-driven approach (GPI horizon) rather than traditional corridor methods.

This allows you to move the focus towards value, which is more helpful when you’re talking with experts who may be advising multiple companies at once. We also believe that when it comes to pricing, it’s important to have a differentiated approach from other companies in the pipeline. This could be particularly useful when the pool of payers is fairly small, as it often is in the orphan drug space and your competitors are likely speaking with the same experts.

Measuring commercial impact

Challenge:

The challenge of measuring a commercial impact from qualitative payer insights is that it’s difficult to communicate the actual impact of a decision in cross-functional discussions – conveying what this means commercially and how to communicate this to internal stakeholders.

Solution

Our approach is to quantify payer’s perception of value for all the various components that can contribute to an asset’s value in each market (country). This allows us to systematically assess an asset’s position in the market and define the levers that may increase the value of your product. This approach helps companies evaluate the commercial and market value impacts of their decisions.

The impact of this approach is the understanding and discussion of value, and of commercial potential, even earlier in clinical development. It creates alignment around strategic decisions surrounding evidence generation.

Evolving policies and payer landscapes

Challenge:

The landscape is always changing, and it will continue to do so in the future. We know that Germany is revisiting how they value orphan products. In five years from now, orphan products may not have the same value or premium as they do now. So, the strategy and assessment need to reflect the future and any unanticipated changes.

Solution

The way we approach this is by comparing the value of an asset at this current point in time versus the future landscape. We do this using analytical models. This proactive approach helps with investment decisions early on.

Tackling multiple scenarios

Challenge:

One of the biggest challenges when developing a new orphan asset is weighing up several scenarios – understanding how that product will fit into the existing or future market. Your product’s price forecast is based on many assumptions that change as the product develops. What if the landscape shifts and you need to quickly test a slightly different TPP? What if you want to test more than the two to three scenarios that you discussed with payers in primary research? What if your original assumptions were wrong, or the landscape shifts in ways that affect your position in the market?

Solution

We use technology and analytics to tackle multiple scenarios. Instead of having to rush through a rapid payer project or an internal assessment, we use our GPI horizon predictive models to test these scenarios – and run multiple simultaneously.

The reason and impact of this approach is to provide the ability to react quickly to landscape changes; shift strategy in real time and support with data-driven, objective outputs. This reduces the amount spent on payer research throughout the lifecycle allowing clients to allocate the necessary funding and resources to payer research when the time is right.

GPI horizon

We have developed a proprietary solution that allows you to track the commercial impact of your qualitative payer insights. Using the latest technology and robust data sources, GPI horizon delivers rapid value assessment and price prediction to inform portfolio strategy and prioritisation, investment decisions for early assets, strategic price and access planning for assets leading up to launch, and price revisions throughout the product lifecycle.

To learn more about what GPI horizon can do for your orphan asset, reach out to us below. You can also stay up-to-date with the latest GPI content by signing up to our newsletter.